Orax SDI Cloud Reference

- Introduction

- Self-Management tools

- Communication and Content management

- Sales and Customer Engagement

- Service Desk

- Project Management

- Automation & Wide-Area-Monitoring

- Job Cards

- Education & B-2-B online training

- Billing and customer statements

- Inventory & Asset management

- Production management

- Human Resources and Payroll

- Procurement and Supply chain

- Ledgers & Accounting

- Reporting and Analytics

- Administration & configuration

Shipping Costs

In many cases you may have shipping or related import costs that are not recorded on the supplier invoice. You may have an invoice from a supplier and another invoice from a shipping company that relate to a specific order. This means that your "landed costs" are more than the "supplier costs" for a specific item.

If you have cases like this (usually when you import), you can effectively deal with this in the Orax SDI system. What is required is that you link the costs in a way that will tell the system to add the shipping cost to the inventory average cost (purchase price). There are 2 different ways to allocate costs to a purchase invoice.

Settings for Shipping Costs

In the Company setup, Settings tab, under the "Suppliers & Purchase documents" section you have to configure a setting to effectively allocate shipping costs. The setting is called "Inventory purchase landed cost expense account" and requires an expense account that will be used for shipping costs. When you allocate payments in the bank related to shipping charges, you need to use this expense account to prevent double posting of shipping costs.

Allocating Shipping Costs

At the bottom of a Purchase Invoice, on the left of the invoice Total, there is a small link called "Add shipping costs". Click this link to start the process.

There are 2 options when you add shipping costs to an invoice:

Record external shipping cost for this Invoice

The first option allows you to add shipping costs recorded in another invoice or bank transaction to the applicable purchase without affecting the item cost on the document. This will only affect the Cost price of the items in the inventory, not the total of this invoice.

When doing this ensure that the "Inventory purchase landed cost expense account" is setup (see Company setup --> Settings --> Suppliers & Purchase documents) and that the other purchase invoice uses the same expense account for the shipping charges. This is required to ensure that the shipping invoice is cancelled as the expense is now recorded in the cost of the items (landed cost).

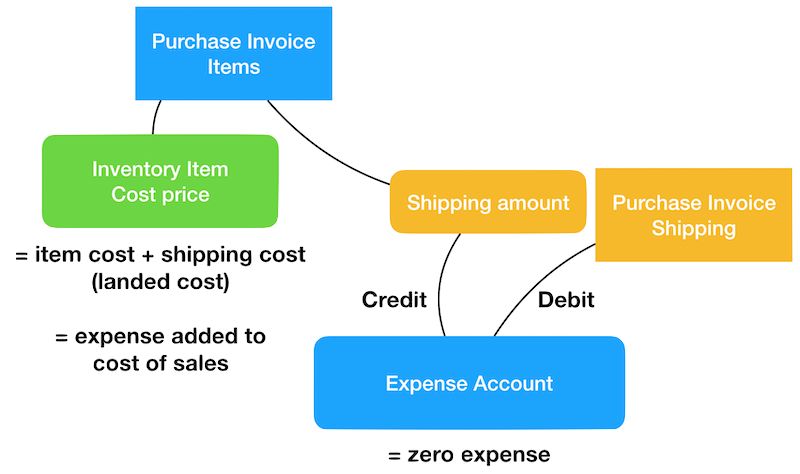

In the following diagram you'll see the relation of the documents when you use this first option.

Add shipping cost to item cost for this Invoice

The second option allows you to distribute the shipping costs included in this Invoice to all items proportionately, provide the actual total for the invoice. Select if this total includes VAT. All items loaded on this Invoice will be proportionately increased to reach the new total. This means that it is not necessary to add a shipping line item, it will become part of the item cost. Only use this option if you will not be capturing shipping charges in another invoice or bank transaction as it will result in double booking of the shipping charges!

Verifying and understanding

After posting this document to the GL you will be able to see the entries in the "Cost & price analysis" section at the bottom of this invoice. Examine the postings to verify that you are using the correct option above and that your process is sound.