Orax SDI Cloud Reference

- Introduction

- Self-Management tools

- Communication and Content management

- Sales and Customer Engagement

- Service Desk

- Project Management

- Automation & Wide-Area-Monitoring

- Job Cards

- Education & B-2-B online training

- Billing and customer statements

- Inventory & Asset management

- Production management

- Human Resources and Payroll

- Procurement and Supply chain

- Ledgers & Accounting

- Reporting and Analytics

- Administration & configuration

Production accounting

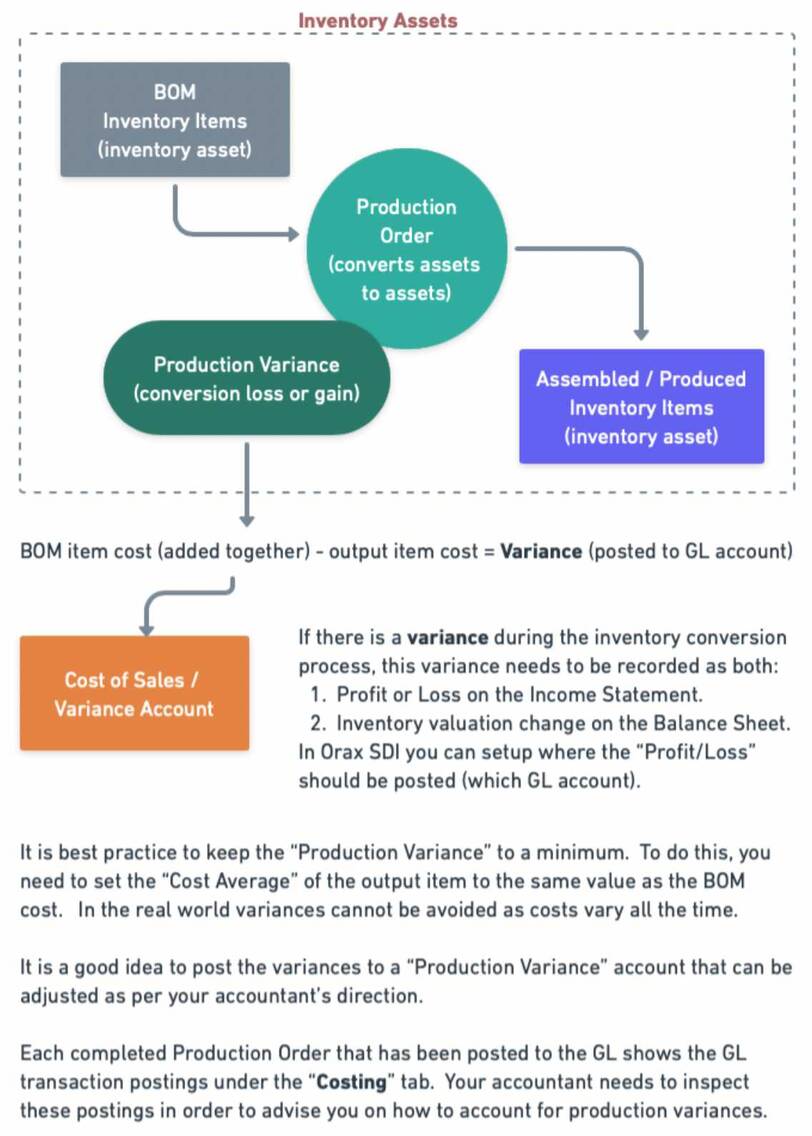

Production orders convert inventory assets into other inventory assets. It therefore adjusts your inventory. If this adjustment has financial impact (eg. the inventory is now worth more because of the conversion), that impact has to be recorded in the Income Statement as a profit or a loss and in the Balance Sheet as an increased asset value. This profit or loss and asset adjustment is called a "Production Variance" in Orax SDI.

When you remove 10 items from inventory (raw materials) and add back 1 item (finished goods), the value of your inventory may have changed. The value is based on the "Cost Average" value setup in the Inventory item. The difference between the total cost of your input items and the total cost of your output items is called a production variance. This variance is an income or expense, depending on whether the value of your inventory is now more or less than it was when you started production.

If the value of your inventory is now more than it was before, you have to account for this increase in "asset" value by recording a "profit" in the income statement. This is because you increased the value of your assets without spending money on suppliers. The increase came about because you internally converted your assets and became "more wealthy" because of this conversion. In your company financials the "profit" is offset by the expenses you required to convert your inventory (eg. wages, rent, electricity, etc). The "Production Variance" can therefore be seen as an internal "Revenue" that has associated "Expenses". If setup correctly, your internal manufacturing process can have its own Income Statement. This is handy to ensure that your production processes do not run at a loss.

The increased value of your inventory assets will increase your future Cost of Sale, and therefore result in a lower reported profit when you sell your inventory assets.

The net effect therefore of a production variance where the output cost is greater than the input cost is that you report an immediate internal profit in your income statement for the period and increase your wealth in your balance sheet (inventory assets). This profit is usually offset by the expenses you record against the production process (eg. wages and other production expenses). In a future period, when you sell these inventory assets, you'll report a smaller profit, because you already recorded a part of the profit during the conversion process.

The flip-side of this process is when the output cost is smaller than the input cost (very seldom the case). This means that your inventory devalues while you report a loss in your income statement. Your future Cost of Sale will then be lower and you will report a larger profit when you sell these assets.

Production accounting should be based on the strategy your company wants to follow when it comes to recording variances as well as whether you want to record profit/loss immediately or in the future. Do you want to invest the variance in "inventory assets" or do you want to record immediate changes. This becomes more interesting when you sell make-to-order assets, because you sell these output items immediately (usually in the same period). In this case, the profit/loss is balanced immediately and has a smaller effect on your financial statements.

Always remember that unless the production function in your company is isolated in your financials, you will not know exactly whether you produce as a loss and only recover that loss through sales margins. It is best to ensure that your production process is isolated into its own division so you can properly account for it.

Orax SDI allows you to setup a standard GL account that "Production Variances" will be posted too. Your accountant will be able to advise which account that should be. It is a good idea for your accountant to inspect some of the postings of completed production orders under the "Costing tab". This information will allow your accountant to advise the best strategy for your company, based on your strategic goals.

Orax suggests that you create an "Production Variance Increase" income-account for this purpose so you can report a complete income statement for your production division.

For company management to have visibility into your production processes and accurate profit / loss information, you need to ensure that the impact of production losses or profits are not clouding your financial performance statements (Income Statement). Management should be able to understand the effect of production as a separate component from day-to-day gross profit. If that is not the case, management will not be able to effectively manage the financial performance of your company.